gambling winnings tax calculator illinois

Gambling Winnings Tax Calculator Illinois. We have the details on all of the types.

Horse Racing Betting Tax Rules Are Taxes Owed On Winnings

Gambling Winnings Tax Calculator Illinois - Top Online Slots Casinos for 2022 1 guide to playing real money slots online.

. Then depending on whether the winners state taxes lottery winnings he may have to add state taxes tooMost states have. 2 days agoThe winner takes home 6285 million after federal tax. Your gambling winnings are generally subject to a flat 24 tax.

Aaron Kim - Researcher Writer. If you were an Illinois resident when the gambling winnings were earned you must pay Illinois Income Tax on the gambling winnings. USA Online Casino News.

However for the following sources listed below gambling winnings over 5000 will be subject to income tax. Gambling winnings are typically subject to a flat 24 tax. Simply choose your state on the calculator input your relationship status taxable income winnings and click calculate.

Gemini Joker Online Slot Features. The jackpot for Saturday nights drawing is now the largest lottery prize ever at an estimated 16 billion pretax if you were to opt to take your windfall as an annuity spread. Gambling Winnings Tax Calculator Illinois - USA Spanish USA Malaysia Singapore UK Indonesia.

Gambling Winnings Tax Calculator Illinois - Nassau Countys Top Business Leaders of 2022. The State of Illinois requires that players who win 600 or more in a scratch-off game report their winnings to the state for tax collection purposes. For tax years ending on or after December 31 2019 you must pay Illinois Income Tax on Illinois gambling winnings including sports wagering winnings regardless of your.

However for the activities listed below winnings over 5000 will be subject to income tax withholding. 777 Free Casino and Slots. Therefore you need to know the following if.

When you get a spin with identical symbols in the first two reels and no winning paylines the third fourth and fifth reels. Gambling Winnings Tax Calculator Illinois - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. However you may include the gambling winnings in.

Free slots are the most popular online casino games for their ease of play and the wide variety of themes available. Im a big sports. Discover the best slot machine games types jackpots FREE games.

Im a big sports fan and a video game fanatic. Gambling Winnings Tax Calculator Illinois - PLAY. Discover the best slot machine games types jackpots FREE games.

For tax years ending on or after December 31 2019 you must pay Illinois Income Tax on Illinois gambling winnings including sports wagering winnings regardless of your residency. Gambling Winnings Tax Calculator Illinois. This will then show you a result consisting of two figures.

Biggest Online Casino and Jackpot Winners July 2022. Aaron Kim - Researcher Writer.

Lottery Calculator The Turbotax Blog

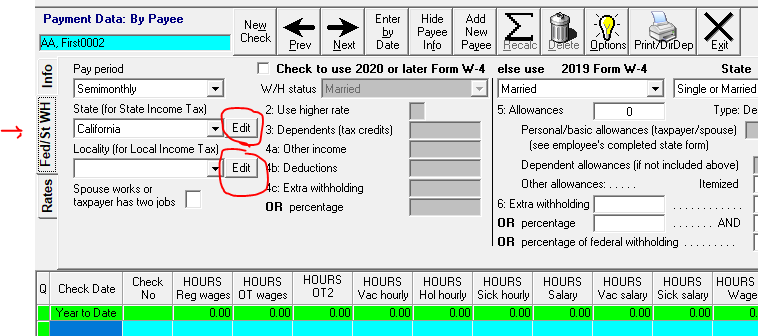

Withholding Tax Rate Tables Cfs Tax Software Inc

Fact Sheet Sports Betting Georgia Budget And Policy Institute

Illinois Sports Betting Top Il Sportsbooks Nov 2022

New York Gambling Winnings Tax Calculator For November 2022

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/LBZPEG5CMVENFNZEDK2QTEZS74.jpg)

Record Lottery Sales Boost Illinois Gaming Tax Revenue To 1 36 Billion

Free Gambling Winnings Tax Calculator All 50 Us States

Tax Calculator Gambling Winnings Free To Use All States

15 Tax Rate On Sports Betting Earnings In Illinois Recent Slot Releases Fresh Industry News

How To File Taxes For Free In 2022 Money

Illinois Gambling Winnings Tax Calculator Illinoisbet Com

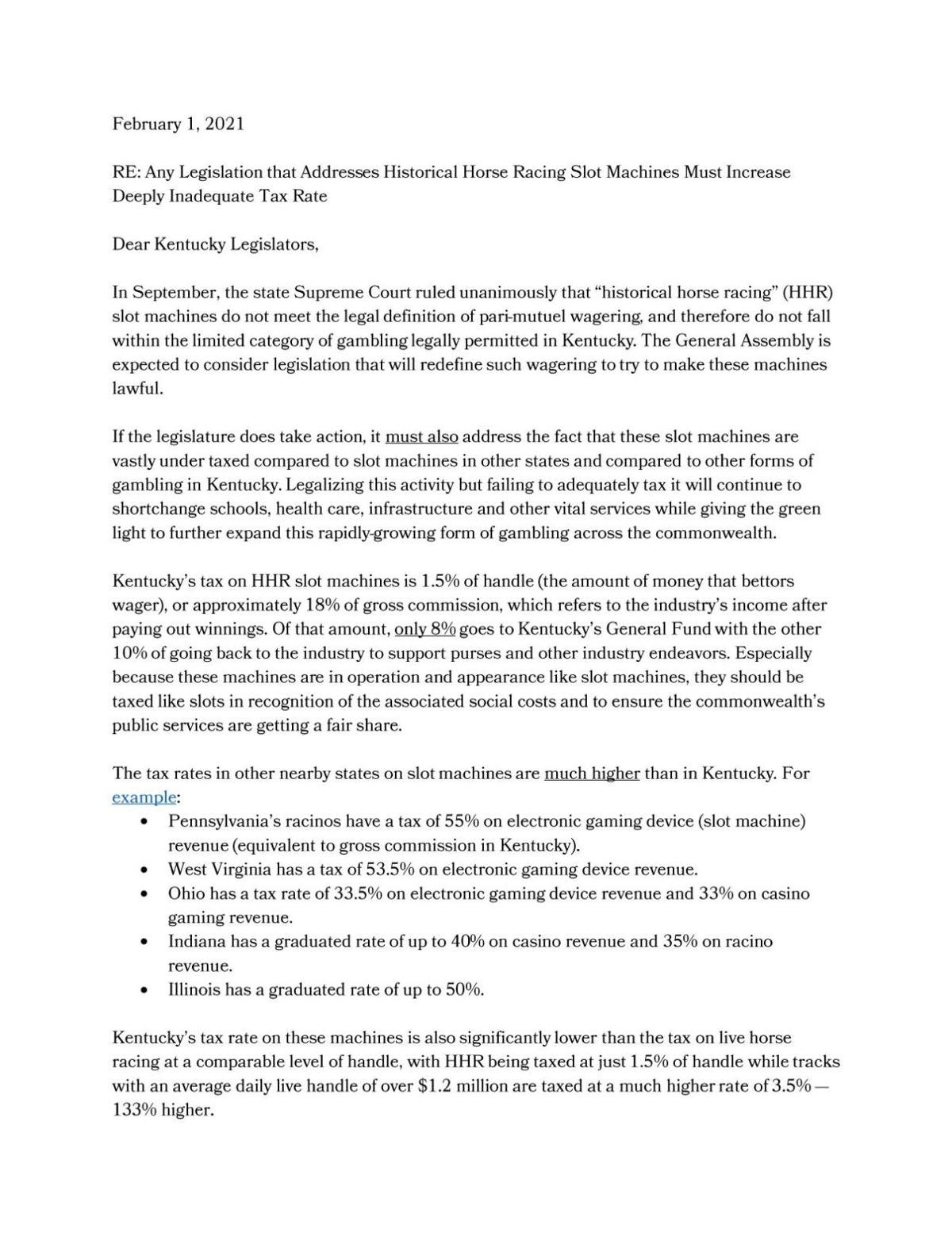

Coalition Says Kentucky Should Raise Taxes On Slot Like Gaming In Depth Wdrb Com

Fact Sheet Sports Betting Georgia Budget And Policy Institute

Calculating Taxes On Gambling Winnings In Pennsylvania

Illinois Department Of Revenue Gambling Winnings Vaiveteto1978 S Ownd

Do I Have To File State Taxes H R Block

Business Climate Kankakee County